QuickBooks -best for invoicing and cash-flow management.TSheets -best for time tracking and custom billing.Saviom -best for resource management and workforce planning.

#Bcba hours spreadsheet software

This software not only helps offices keep track of billable hours, but also makes other useful tasks easier, like productivity analysis, costing, reports, invoicing, and accounting. There are many software options out there, designed to aid resource and practice management. This is how RingCentral’s desktop and mobile app works, as a quick example: Specifically, instead of using separate apps for video conferencing and messaging, try to find a versatile app that can provide different communication channels in one place. To make it easier to track your billable hours, streamline the number of apps you use. This way, your communication platform (which you’re already using to make phone calls, video calls, and so on) automatically logs all your client communication and helps you manage any respective billing efficiently:

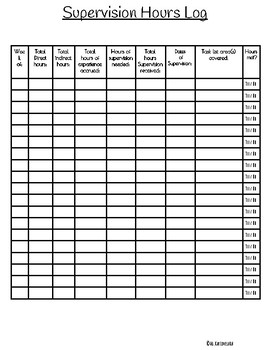

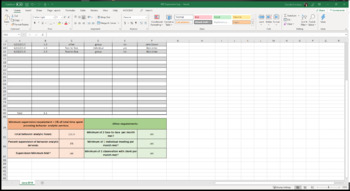

Time trackers like Time Miner can be integrated into your communication app to track how much time is being spent on calls, text messages, and meetings. See how MHP&S, a remote-friendly law firm, easily manages its billing by integrating a time tracking app with its communication platform (which allows them to have video conferences, message each other, and more). Such tools are ideal if you offer legal services or other work where keeping accurate records of billable hours is crucial. It helps to simplify billing clients and provides data to support your invoicing. Digital calculatorĪ digital time tracker or manager is designed to record your working hours. You can input hours worked and pay rate for each client on any given work day, with time-in, time-out tracking. Chart hours in ExcelĮxcel has a template specifically designed for managing your billable hours. Here are some ways to use software and solutions to help track billable hours accurately. Luckily, these days there are lots of tools out there to make keeping on top of billable hours that little bit easier. It can be difficult for lawyers, consultants, accountants, and other professionals who combine billable and non-billable time to keep track.

But with such busy work calendars, how can we differentiate between our billable and non-billable hours effectively? So, we know how important it is to keep track of our billable hours. What is the difference between billable and non-billable hours? Billable hours are, as a result, extremely lucrative for firms. The bill, in most cases, must therefore be paid by the client themself. They are designed to ensure financial compensation for any time spent on individual client cases. For lawyers, consultants, accountants, and other professionals with billable work, these payments do not apply to other work tasks done for the firm to which they are professionally affiliated.īillable hours apply only to clients. In other words, they are the hours that you bill clients for and they pay directly. Billable hours: The true meaningīillable hours are those hours worked that require compensation. Failing to meet the quota could spell trouble. Within the legal profession, for example, attorneys are required to complete a set number of billable hours each week.

Only a select few industries actually have requirements for billable hours. Building contractors and freelancers, for example, could be said to work something akin to billable hours on a daily basis.īut this is not exactly the same thing. The term, “billable hours” can sometimes cause confusion because people in many different professions charge for their work through invoicing.

0 kommentar(er)

0 kommentar(er)